Courtesy:

Courtesy:

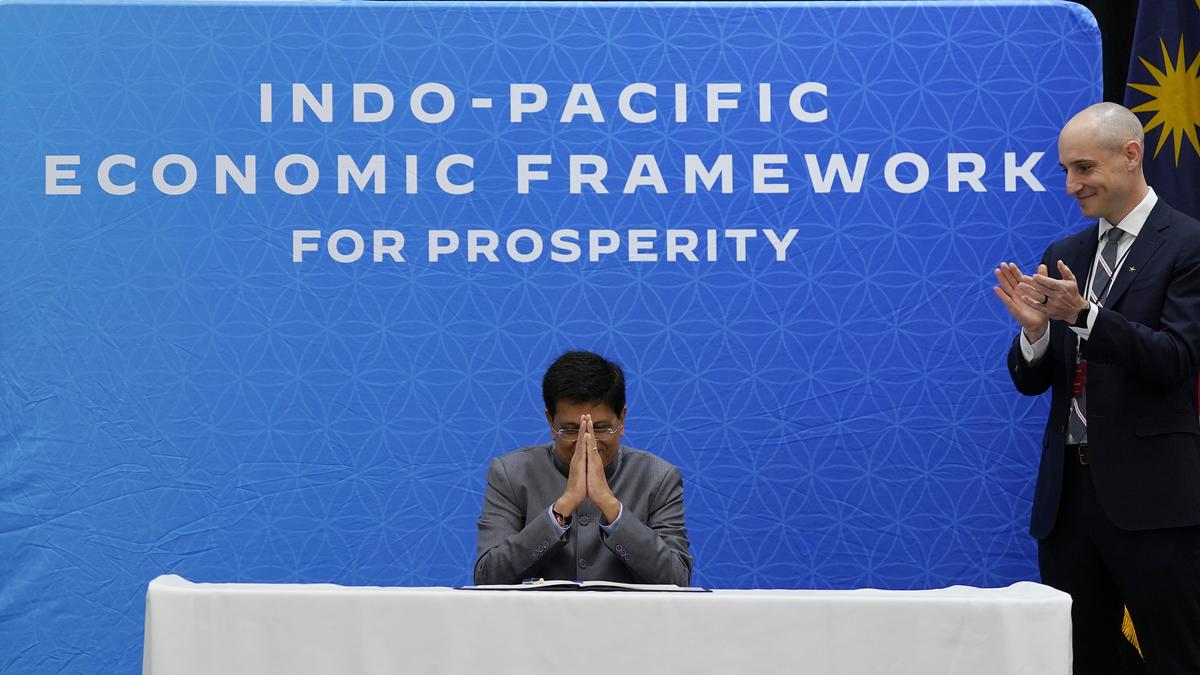

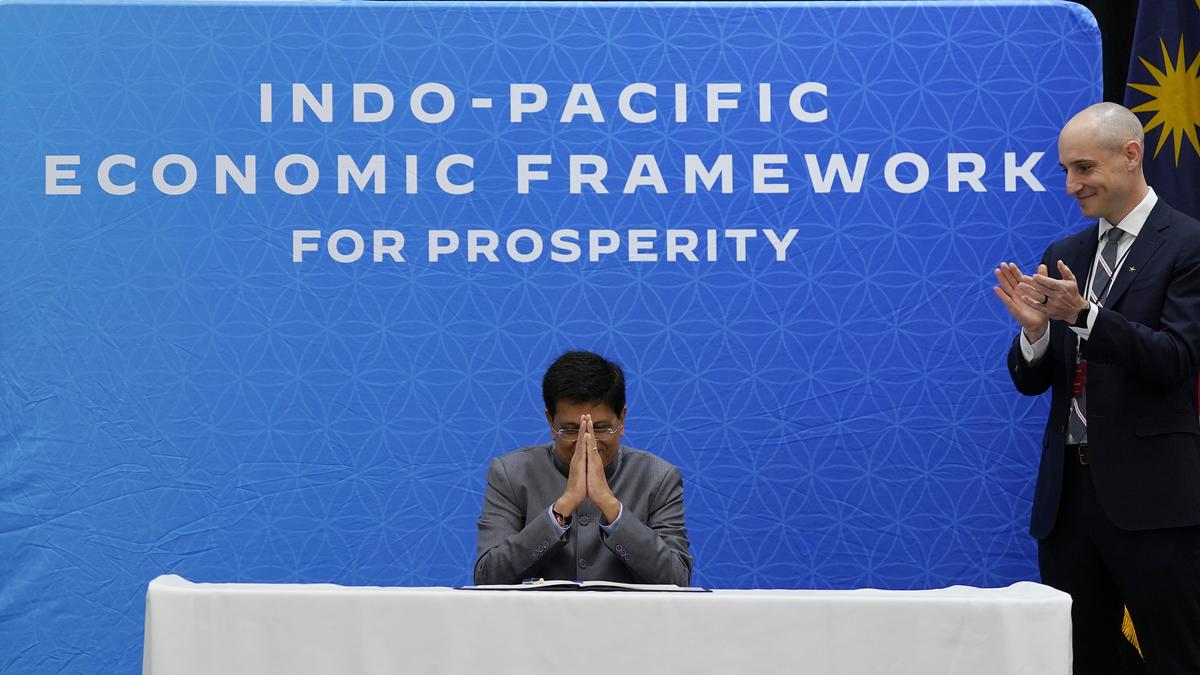

The Indo-Pacific Economic Framework for Prosperity (IPEF)’s Clean Economy Agreement is unique in that it offers multiple benefits for investment, capacity-building and standards-setting, all while pursuing a clean economy agenda, voluntarily. India has already seen success in this area and is a hopeful example for others in the Indo-Pacific.

Courtesy: Shutterstock

Courtesy: Shutterstock

The current notions of physical ‘permanent establishment’ or tangible locational nexus are not well-suited for the taxation of modern digital economy, especially for taxation of business income, rents or revenue creating activities. In a Covid-19 wrecked global economy, where government revenues are under severe stress, there is a compelling case for a market country or the value-creating jurisdiction to tax the income or rents attributable to the concerned market or location.

Courtesy: Shutterstock

Courtesy: Shutterstock

The U.S.-China Trade Agreement, concluded on 15 January 2020, was the result of a trade war. It is limited to agriculture, mainly, and select service sectors of American interest, with provisions designed to prevent imbalances and distortions

Courtesy: World Trade Organisation

Courtesy: World Trade Organisation

The imminent expiration of the terms of some members of the WTO Appellate Body, with neither any signs of their extension nor appointments being made afresh, suggests that this crisis will intensify. An analysis of all that ails the WTO Appellate Body, and the implications this has for India and the multilateral trading system

Courtesy: Neil Palmer (CIAT)/Flickr

Courtesy: Neil Palmer (CIAT)/Flickr

At the World Trade Organisation (WTO)’s ongoing ninth Ministerial Conference, the focus of several countries is on food security. What does the proposed ‘Peace Clause,’ mean for developing nations? What are the complex factors at play in the decision-making process, in the ongoing meeting?