On 19 February 2018, the board of the Dhaka Stock Exchange (DSE) accepted a proposal by a consortium of China’s Shanghai and Shenzhen Stock Exchanges to acquire a 25% share in Bangladesh’s largest stock exchange[1]. There were only two bidders – the Chinese consortium and a rival group, including India’s National Stock Exchange and the U.S. Nasdaq. The winning bid was $119 million in cash – 56% more than the Indian bidder’s offer.

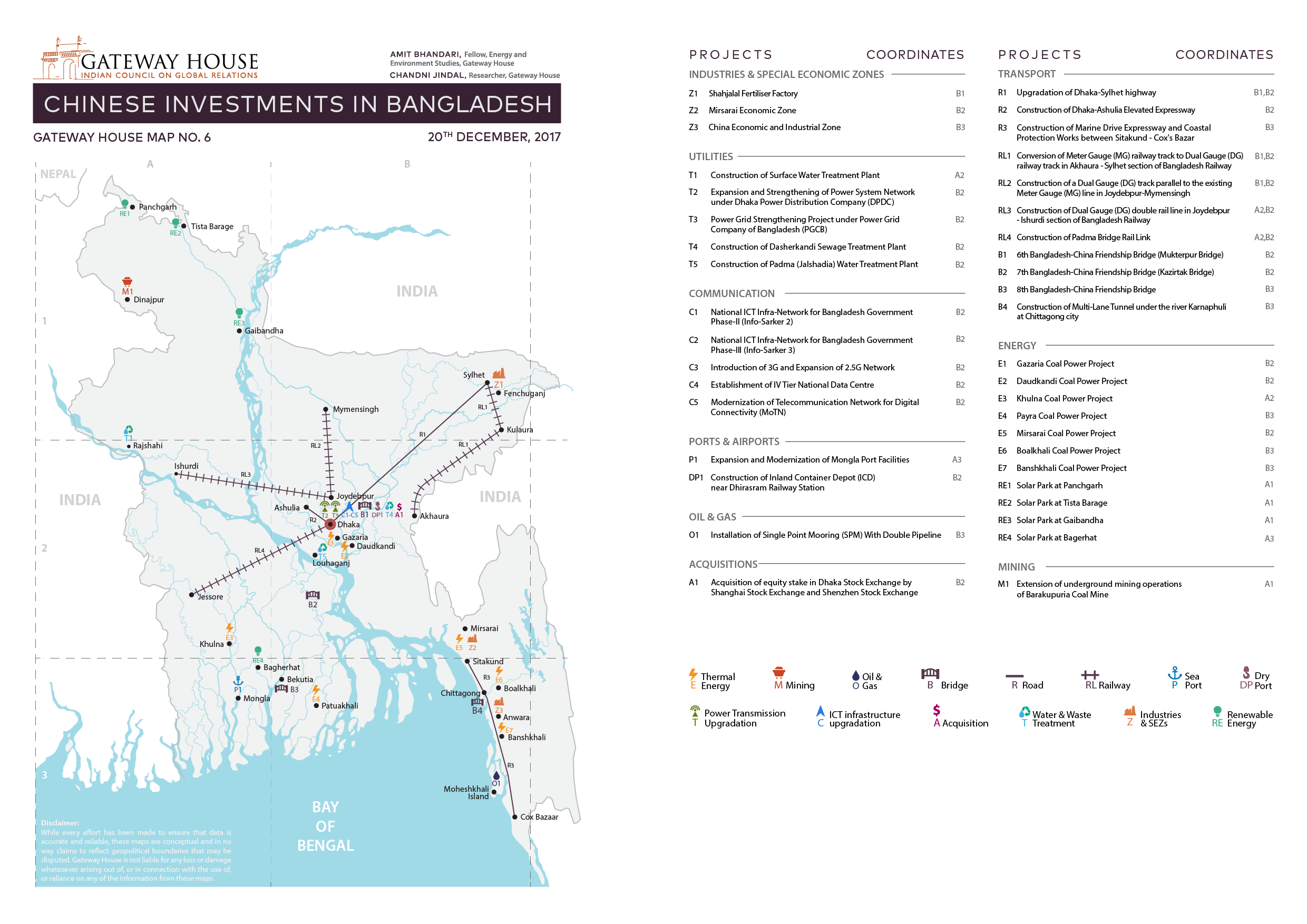

That figure may seem small compared to the $3 billion in projects China launched in Bangladesh during the 10 years that ended in 2017, but it could be a harbinger of more substantial investments to come. A Gateway House analysis (see details in map below) suggests that current plans could see total Chinese investment swell tenfold – to $31 billion. That would be even more than the $20 billion in infrastructure promised by President Xi Jinping during his October 2016 visit to Dhaka. What’s more, the stock exchange investment hints at a strategic purpose behind Chinese investment: by acquiring a substantial stake in the DSE, China will gain greater access to – and possibly control over – Bangladesh’s financial infrastructure and hence the guts of its economy.

The new Chinese investment could be beneficial to Bangladesh, at least in the short term. China’s financial sector, led by Alibaba, is technically formidable, admired and effective. Transferring some of its knowhow to Bangladesh, which is already a global innovator in the financial systems associated with strong economies, can reduce transaction and distribution costs. But the growing Chinese presence also is a cause for worry: such a significant investment in a key pillar of the Bangladesh economy could enable China to influence regulatory and compliance norms in the financial markets in ways that could pave the way for an even larger Chinese role in the economy and ultimately make the country economically and politically dependent on Beijing.

The new Chinese investment could be beneficial to Bangladesh, at least in the short term. China’s financial sector, led by Alibaba, is technically formidable, admired and effective. Transferring some of its knowhow to Bangladesh, which is already a global innovator in the financial systems associated with strong economies, can reduce transaction and distribution costs. But the growing Chinese presence also is a cause for worry: such a significant investment in a key pillar of the Bangladesh economy could enable China to influence regulatory and compliance norms in the financial markets in ways that could pave the way for an even larger Chinese role in the economy and ultimately make the country economically and politically dependent on Beijing.

Bangladesh is the most vibrant economy in India’s neighbourhood with the least Chinese penetration; during 2016-17, China (including Hong Kong) accounted for just 7.3% of all foreign direct investment (FDI) in Bangladesh. As a result, Bangladesh has been able to refuse China, as it did in the case of the proposed Sonadia Port that China wanted to develop. It also has significant and growing economic ties with India – and is open to Indian investment. During FY17, Indian FDI in Bangladesh was $95 million – less than China’s total, but still substantial. India already sells electricity to Bangladesh[2], Indian companies are exploring for oil and gas in Bangladesh and the country is considering a proposal to construct a petroleum product pipeline from an Indian oil refinery to Bangladesh[3]. The prospects for such investments could evaporate if financial norms favour proposed Chinese investments in Bangladesh.

Bangladesh has become a target of opportunity for China. Like other low-income countries, it desperately needs infrastructure like roads, bridges and power-projects. But multilateral lenders are leaving the field open to new investors. The World Bank and the Asian Development Bank, perhaps reflecting environmental concerns in more developed countries, no longer finance coal-fired power plants. And even though the country needs bridges to allow more efficient shipments of goods, the World Bank scrapped assistance for a crucial bridge on allegations of corruption[4]. As a lower income country with weak institutions and poor infrastructure, Bangladesh has trouble meeting standards for financial management set in the developed world. China has readily offered to build much needed power plants, bridges and roads with fewer strings attached, and the country has eagerly accepted.

The Gateway House map of Chinese investments in Bangladesh shows the scope and scale of China’s ambitions. Most of these projects exist so far only on paper; the agreements were only inked in late 2016. But if they move ahead, China will become the largest foreign investor in Bangladesh by a large margin. What’s more, China’s role as a major weapons supplier already gives it leverage with the country’s politically powerful military.

As the Sri Lankan experience has shown, without transparency and proper controls, Chinese lending to help poor countries pay for such investments can push them into a debt-trap – a level of financial obligation that can reduce their economic options. These investments also can alter political geography, leaving them unable to resist political pressures from their benefactor; this has already happened in the Maldives.

India has been unable to match China’s big-ticket infrastructure spending on its own. It could work with Japan, which is trying to increase its own infrastructure investments in the region; it is helping Bangladesh develop a deep-sea port, at the expense of a Chinese project, for instance. India, meanwhile, could take steps to improve infrastructure supporting border trade with Bangladesh, investments that could help reduce the appeal of Chinese infrastructure. Such opportunities could be lost if China gains disproportionate economic power.

So far, Bangladesh has shown itself to be willing and able to seek the best terms for itself and keep a balance between various powers. The question is whether countries like India will act in time to ensure that Bangladesh retains its freedom to choose.

Amit Bhandari is Fellow, Energy and Environment Studies at Gateway House

The ‘Chinese Investments in Bangladesh’ map was researched by Amit Bhandari and Chandni Jindal and mapped by Debarpan Das

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in.

© Copyright 2018 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.

References:

[1] ‘Dhaka Stock Exchange greenlights China bourses as strategic partners as India, US lose out’, bdnews24.com, 19 February 2018, <https://bdnews24.com/business/2018/02/19/dhaka-stock-exchange-gives-final-nod-to-china-bourses-proposal>

[2] Statistics Department, Bangladesh Bank, Foreign Direct Investments in Bangladesh, Survey Report January – June 2017, <https://www.bb.org.bd/pub/halfyearly/fdisurvey/fdisurveyjanjun2017.pdf>

[3] Ministry of Petroleum & Natural Gas, Government of India, Sh Dharmendra Pradhan meets his Bangladesh counterpart Mr Nasrul Hamid, <http://pib.nic.in/newsite/mbErel.aspx?relid=151455>

[4] Press Release, World Bank, World Bank Statement on Padma Bridge, <http://www.worldbank.org/en/news/press-release/2012/06/29/world-bank-statement-padma-bridge>