This is part one of a two part series. You can read part two here.

The global economy looks in better shape and the long awaited recovery seems to be taking root, but the key drivers of global growth have shifted. Growth has been marked down in the United Kingdom, but a cyclical pick-up in investment and trade in the other advanced economies – especially in Europe and Japan where the demand momentum appears stronger than previously envisaged – has led to better-than-expected growth. Japan has experienced six consecutive quarters of above-potential growth. Higher commodity prices, such as petroleum and metals, have helped commodity exporters emerge from recession.

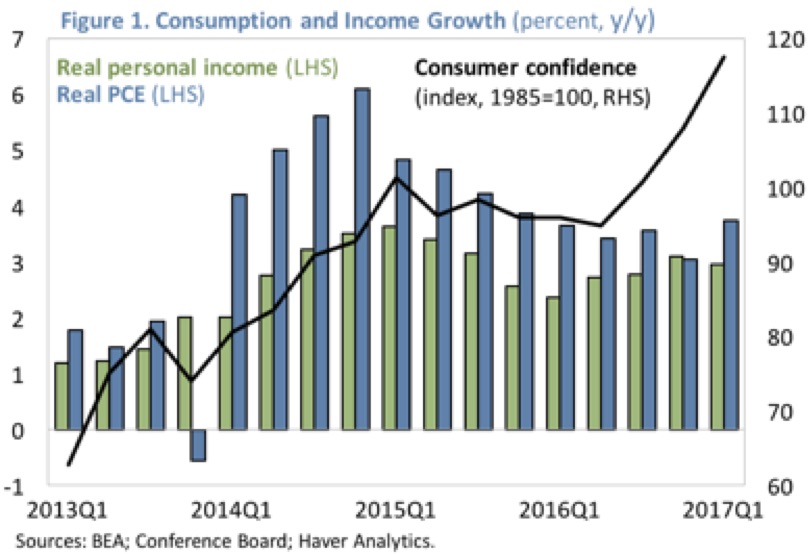

Forecasts for the United States have been reflective of changing prospects for tax reform and large-scale fiscal stimulus. Nevertheless, second quarter growth came out better than expected at just above 3%, and the likelihood is that U.S. growth will be above the 2% trend this year – and the next. Certainly, we are seeing rising incomes, solid consumption indicators, and rising sentiment in the U.S. (Figure 1), that have raised business (and energy-related) investment. Also, home sales and construction are rising close to pre-crisis levels. Despite recent hurricane-related losses, at an unemployment rate at 4.2% (the lowest since 2001), the U.S. labour market has tightened to full employment, and the unemployment rate could fall below 4%.

Overall, global growth should accelerate to 3.6% in 2017 and further to 3.7% in 2018, somewhat above previous expectations. The outlook is helped by improved prospects for many emerging economies. It helps that global financial conditions remain accommodative. Amid market optimism, credit spreads are low, equity markets in advanced economies are at record high levels, bond spreads are tight, and market volatility is unusually low. The U.S. Federal Reserve raised its monetary policy rate in June 2017 to 1.25%, but with large fiscal stimulus less likely, markets now expect a more gradual normalisation of monetary policy. While all this constitutes a relatively favourable outlook, growing debt levels signal that risks could lie ahead: a rapid increase in credit spreads and greater market volatility could significantly worsen the outlook for global growth.

Meanwhile, Asian markets remain strong, and the region still contributes more than half of global growth. With the notable exceptions of India and Australia, most countries in Asia have seen growth outturns in the first half of 2017 that were better than anticipated, helped by strong domestic demand, and large capital inflows to the region. Also, export growth has also been a key contributor to growth across most Asian countries, with the upswing in commodity prices and the restocking of tech inventories being key drivers. Significantly, a large part of the export increase has come from intra-Asian trade, driven by robust demand in Asia’s emerging markets.

In China, growth accelerated to 6.9% in the first half of 2017, reflecting recovering global trade, continued strong infrastructure spending, and resilience in the real estate sector. Besides, the expectation is that the government will keep policies sufficiently accommodative to achieve its objective of doubling the 2010 GDP by 2020, although this risks increasing debt imbalances. On this basis, China’s growth should reach 6.8% in 2017 and average 6.25 % during 2018-20.

In India, although macro indicators remain stable, growth slowed in recent quarters on account of disruptions from demonetisation in November 2016 and, more recently, uncertainties related to the implementation of the Goods and Services Tax (GST). As such, growth was revised downward to 6.7% in FY2017 and to 7.4% in FY2018. Growth remains underpinned by private consumption, which has benefited from low food and energy prices, and the policy challenge is to revive flagging business investment.

Overall, the near-term outlook for Asia remains strong, supported by the pickup of the global economy and broadly accommodative policies and financial conditions. These factors should underpin domestic demand, offsetting a likely tightening in global financial conditions, and a plateauing of the global tech inventory cycle.

Discussions at the Annual Meetings need to focus on addressing whether the growth fundamentals in advanced countries and emerging markets are supportive of sustaining the recent trends, and dealing with related social and political concerns about rising income inequities in many advanced and emerging market countries.

Anoop Singh is Distinguished Fellow, Geoeconomics Studies at Gateway House: Indian Council on Global Relations.

This is part one of a two part series. You can read part two here.

This article was exclusively written for Gateway House: Indian Council on Global Relations. You can read more exclusive content here.

For interview requests with the author, or for permission to republish, please contact outreach@gatewayhouse.in or 022 22023371.

© Copyright 2017 Gateway House: Indian Council on Global Relations. All rights reserved. Any unauthorized copying or reproduction is strictly prohibited.