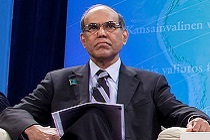

T20 Mumbai Keynote by Dr. Rajan

Dr. Raghuram Rajan, Governor, Reserve Bank of India, delivered the keynote address at India's first Think20 (T20) meeting organised by Gateway House with TEPAV, on the "Global Economy and Challenges for Multilateral Policies." He urged emerging markets like India to develop their own capacity to provide new ideas to the global financial system, “hold the pen” that will write a more inclusive agenda, and strengthen global multilateral institutions.