Trump’s Iran sanctions hit India

India may end up being the unintended victim of renewed U.S. sanctions on Iran. It will push up the price of oil and cost India billions of dollars annually

Courtesy: Gateway House

Courtesy: Gateway House

India may end up being the unintended victim of renewed U.S. sanctions on Iran. It will push up the price of oil and cost India billions of dollars annually

Courtesy:

Courtesy:

“It will be the jump in crude prices that will trouble India more,” said Amit Bhandari, Fellow, Energy & Environment Studies, Gateway House, to Rakesh Sharma at Energy Intelligence, elucidating upon the possible implications for India if the Iran Deal Read more

Courtesy: Gateway House

Courtesy: Gateway House

India has benefited from three years of low petroleum prices. The tide is now turning, with oil moving from a benign $50 to $70 a barrel. This is a good time for it to start using financial instruments and asset purchases, as other countries do, to protect itself against further price rises

Courtesy:

Courtesy:

The removal of 11 top ministers in the Riyadh government last week by the young crown prince Mohammad bin Salman, is a geopolitical upheaval, the implications are serious. Domestically, the kingdom is seeking to liberalise its conservative society and move away from oil-dependency – evident from the expected listing of its crown jewel Aramco. For India, which imports oil largely from West Asia, instability could cause a spike in prices, leaving less for its ambitious reforms. Globally, there is now space for new alignments – in the Great Power plays, in the Shia-Sunni rivalry, and in the war on terrorism.

Courtesy:

Courtesy:

In a policy brief for the Russian International Affairs Council, Vasily Shikin and Amit Bhandari examine the existing energy partnership between India-Russia, evaluate the potential of new collaboration formats, and develop specific recommendations for enhancing cooperation.

Courtesy: New York Times

Courtesy: New York Times

Three epoch-making events in 2016 are continuing to have global repercussions. They were: Brexit, China’s rubbishing of the July verdict of the Permanent Court of Arbitration after it rejected its claims on disputed islands in the South China Sea, and Trump’s election. This article, the prologue to a book-in-progress, The Hinge Year – Geopolitical Dislocations and Dispersals, outlines how these events intersect with transformed geoeconomic realities

Courtesy: Asharq Al-Awsat

Courtesy: Asharq Al-Awsat

Saudi Arabia and its allies have broken off diplomatic ties with Qatar, but Iran may be their real target, a possibility reinforced by some recently leaked emails from a UAE diplomat

Courtesy: Wind Power Monthly

Courtesy: Wind Power Monthly

Improvements in wind energy technology can not only benefit India’s energy profile, but also enhance relations with neighbouring countries

Courtesy: Wikimedia Commons

Courtesy: Wikimedia Commons

Japanese technology giant Toshiba is sinking into a financial morass due to its near bankrupt nuclear power business, Westinghouse. India must recognise the new reality that nuclear energy is no longer financially viable

Courtesy: Gateway House

Courtesy: Gateway House

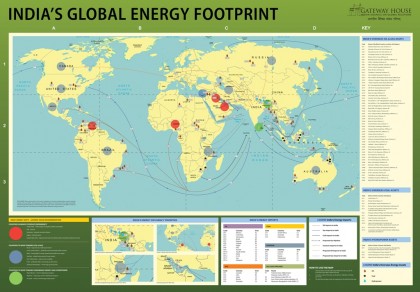

Trends in technology, geopolitics and geoeconomics have dramatically transformed the global energy scenario in the last two years. This means favourable conditions for import-dependent India, which must use the opportunities available to reduce its vulnerability to high energy prices. The jump in oil prices past the $60 mark suggests that India must act with alacrity. India’s Energy Footprint Map offers a profile of India’s global trade and investment in energy, and indicates what India can do to access cheap and reliable supplies