The big U.S. downgrade: Folly or foresighted?

The downgrade of U.S. Treasury securities by Standard & Poor’s has once again brought the spotlight on rating agencies. There appears to be a political and economic flashpoint underlying this downgrade.

Courtesy: RyanLawler/Wikipedia

Courtesy: RyanLawler/Wikipedia

The downgrade of U.S. Treasury securities by Standard & Poor’s has once again brought the spotlight on rating agencies. There appears to be a political and economic flashpoint underlying this downgrade.

Courtesy: WorldEconomicForum/Flickr

Courtesy: WorldEconomicForum/Flickr

As the new head of the IMF, Christine Lagarde’s experience in cajoling world leaders will go some way in negotiating the European bailouts. The real challenge, however, will be trying to raise funds for anything as large as Italy.

Courtesy: dilmarousseff/Flickr

Courtesy: dilmarousseff/Flickr

As Europe stands united in its support for France's Finance Minister Christine Lagarde as a candidate to head the International Monetary Fund, many have begun to question if BRICS is truly an effective and united bloc. Will they be able to put forth a candidate all emerging countries can support?

Courtesy: WorldEconomicForum/Flickr

Courtesy: WorldEconomicForum/Flickr

With the post for the head of the International Monetary Fund up for grabs, the emerging market countries are yet to unite and provide a suitable candidate who receives formidable support for his or her candidature. China, however, may boldly question the status quo and step ahead.

Courtesy: Katrina.Tuliao/Flickr

Courtesy: Katrina.Tuliao/Flickr

The 2008 financial collapse has economists pondering over the stability of global economies and the ability of those with financial power to maintain their wealth. If such a situation recurs, who will be held accountable?

Courtesy: SamanthaAppleton/WhiteHouse

Courtesy: SamanthaAppleton/WhiteHouse

Indo-US business dealings and the US Federal Reserve’s money-printing initiative may have saved Chinese President Hu Jintao the headache of explaining – to his American counterpart – China’s stealth fighter shocker, undervalued currency and giant trade surplus.

Courtesy: ChuckKennedy/WhiteHouse

Courtesy: ChuckKennedy/WhiteHouse

Chinese President Hu Jintao’s visit to the US comes at a time when the geopolitical situation in Asia and the Asia-Pacific region is fluid - consequent to the US deciding to re-energise relations with countries in the region - and when Sino-US relations have been under some strain.

Courtesy:

Courtesy:

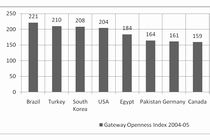

Over the past decade, emerging markets that have liberalized are far more open to foreign banks in their markets than are developed economies. A Gateway House study of financial services in 11 countries: four BRIC countries, one emerging market, four developed economies and two developing markets.

Courtesy: PeteSouza/WhiteHouse

Courtesy: PeteSouza/WhiteHouse

For a moment, President Obama’s Asia tour served as a diversion from the abysmal results of the US midterm election. By the end of the tour, the Obama administration was swept up in the backlash of currency crisis. Can Barack Obama be the president America needs?