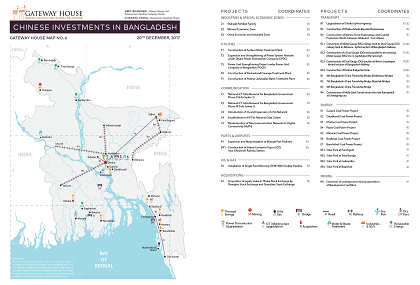

Bangladesh: Controlling Financial Infrastructure

China’s investment in Bangladesh’s stock exchange gives Beijing a chance to shape the financial architecture of the most vibrant economy in India’s neighbourhood

Courtesy: Gateway House

Courtesy: Gateway House

China’s investment in Bangladesh’s stock exchange gives Beijing a chance to shape the financial architecture of the most vibrant economy in India’s neighbourhood

Courtesy: Gateway House

Courtesy: Gateway House

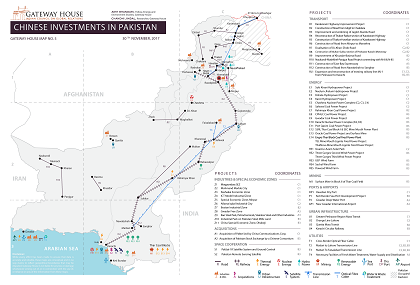

The China-Pakistan Economic Corridor is a strategic play by China disguised as an economic corridor. It may bring some economic benefits to Pakistan in the short run, but will almost certainly cost the country – and India – a big political price in the long run

Courtesy:

Courtesy:

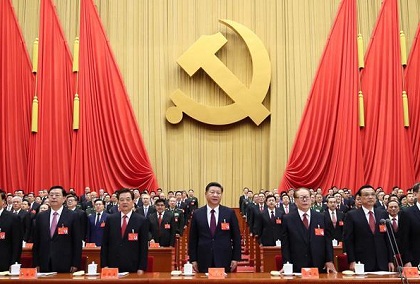

For the last fortnight, the world has been captivated by the events of the 19th National Congress of the Communist Party of China, which elevated Chinese President Xi Jinping to the status accorded to Chairman Mao. Xi Jinping has consolidated his position in the CCP, strengthened his hold over the country and provided a policy road-map for the next five years. 'Xi' Jinping Thought' is now enshrined In the Chinese Constitution just as firmly as was 'Mao Zedong Thought'.

Courtesy: Tribune

Courtesy: Tribune

Beijing has its finger on the economic pulse of the country, demonstrating a responsiveness to criticism at home and abroad. It reveals a great deal about Chinese political priorities and societal changes, and offers a collective learning for investors and markets worldwide – and especially for India.

Courtesy: Western Naval Command

Courtesy: Western Naval Command

China has expanded its presence in the Indian Ocean Region. President Xi Jinping has abandoned Deng Xiaoping’s conciliatory posture for an aggressive, money-fuelled search for super power status

Courtesy: News Max

Courtesy: News Max

China’s credit-led growth is likely to lead to a fairly severe economic crisis in the next two or three years. Recent research suggests that the current tactics may boost short-term growth, but harm its long-term prospects. Time is running out for the country’s ambitious policy-makers

Courtesy: Narendra Modi/ Flickr

Courtesy: Narendra Modi/ Flickr

BRICS, which has always been committed to enhancing solidarity, is now entering its second decade – even as tensions between its two most consequential members remain unresolved and member states and other emerging markets are set to serve as “the main engine” of global growth

Courtesy: Gateway House

Courtesy: Gateway House

The Indian government may block the acquisition of Gland Pharma by Shanghai Fosun Pharmaceuticals, a move that offers further confirmation of how China’s opaque business model is causing concern worldwide. This infographic shows some high-profile cases of acquisitions by Chinese companies that ran into local opposition

Courtesy: Gateway House

Courtesy: Gateway House

The multi-polar world that BRICS nations seek is not a reality yet and the differences between them do exist. But the BRICS summit in September offers leaders an opportunity to examine a few important financial issues before they can dictate the global agenda

Courtesy: AFP

Courtesy: AFP

The Indian government must be commended for staying away from the Belt & Road Forum in Beijing this week on the basis of principled objections. However, the forum has robust global participation – 30 heads of state attended the meeting, as did the chiefs of the UN, World Bank and International Monetary Fund (IMF). India was the only country in the world that was invited, but refused to participate